CFD trading is a type of derivative trading – implying that you are concerned with values originating somewhat from the underlying market, not the whole underlying market itself though. There are a whole lot of benefits to it anyway:

- Leverage

CFDs make it easier for your investment money to move forward, when you just have to put down a deposit of fraction of the full amount of your exchange to free up your position. Perhaps the deposit you are going to have to go through deposit is considered the gross margin. Automated API Trading is considered as the best thing.

Just how much you really need to make a deposit depends fully on the scale of your place and the gross margin major factor also for your own selected market. There are a lot of Energy Trading Companies present in the market.

However still, it is necessary to note that your net benefit or loss is focused on the entire scale of your position today, not your own deposit.

- Going a bit low

because even though CFD Spot Energy global trade consists largely of an arrangement to swap the major difference here between the opening and closing market price of further your own position, it is more versatile than other modes of trading. This helps you to make a trade even in global markets that are both down and up.

Whenever sometimes you really buy CFDs on a trading site, you can see two prices clearly listed: the buying price and the sale price. Then you really trade at the average selling price if now you just think the economy is going to go up even in price and sell again the price point if so you really think it is going to go somewhere come down in price.

- Trade a wide variety of markets

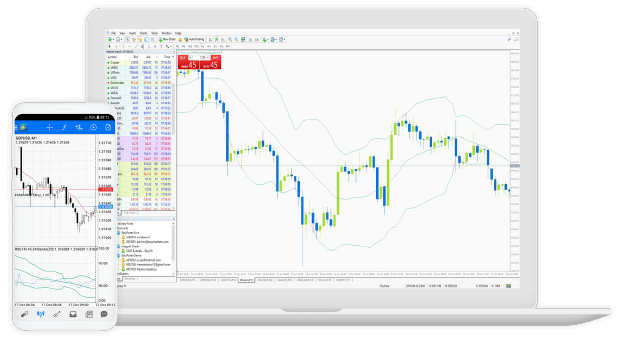

You will use exchange differential contracts on more than 17,000 global markets, including bonds, indexes, agricultural commodities, forex trading, crypto currencies, etc. And you do not have to direct access several exchanges to trading on various markets. Anything is available under one username, anywhere you need it – you can trade from your web browser, Smartphone or tablet.

You should also sell certain markets before business hours and make the best of the company's business major announcements. Just bear in mind however that the opening price of the whole market may be different from even that of the out-of-hour price point.

- Hedging your own portfolio of shares

Say, for example, that you own instead a number of shares even in HSBC and expect to keep the company shares now over the mid to long term. You assume that the financial industry is going to be in a slump, and you want to either offset any future damages by using Trade Forex CFD. So you are opening up a short spot. however if you are right and all your other HSBC shares are reduced in real value, your own CFD position would give you a return, offsetting all your loss.

- DMA

If you are an advanced investor, you will have exclusive market entry (DMA). This helps you to access and communicate with stock exchange order books and otherwise forex suppliers. Instead of selling at the buying and selling rates offered by IG, then you really can see all open bids and deal prices at any other given time period, and try to sell again at the current market prices now you just choose. Always choose the Best Cfd Traders.